Around the same time that Sterling Currency Group was shut down another dinar site vanished from the internet. The Dinar Corp site vanished from the internet with little commentary on what was going on. The FBI seized the site and preserved their documents. What really happened?

Around the same time that Sterling Currency Group was shut down another dinar site vanished from the internet. The Dinar Corp site vanished from the internet with little commentary on what was going on. The FBI seized the site and preserved their documents. What really happened?

“The U.S. Commodity Futures Trading Commission (CFTC) today announced the unsealing of a civil enforcement action filed in the U.S. District Court for the Middle District of Alabama, charging Husam Tayeh of Oak Lawn, Illinois; Dinar Corp., Inc. (DCI), a Nevada corporation; and My Monex, Inc. (Monex NV), a Nevada corporation (collectively, the Defendants), with operating a fraudulent scheme involving foreign currency (forex), and failing to register with the CFTC as required by federal law. The CFTC Complaint further names Theodore S. Hudson, II and his company My Monex, Inc., an Alabama corporation (Monex AL), both of Dothan, Alabama, as Relief Defendants.”

Reading through the indictment many things came to light, but Iraq Currency Watch withheld commentary. The reason for this was because Dinar Corp had a bad habit of suing those who put negative comments about them on the internet. We have tangled with them before. I will go into a little more detail.

Sterling Currency Group was not the only dinar dealer that had a paid network of gurus. Dinar Corp had a network of gurus as well. Dinar Corp would sue individuals for making negative statements even if those statements were true. The idea was to shut down the person giving them a bad review. In many cases, they just threatened to sue and that was enough to get things removed from the internet.

Sterling Currency Group was not the only dinar dealer that had a paid network of gurus. Dinar Corp had a network of gurus as well. Dinar Corp would sue individuals for making negative statements even if those statements were true. The idea was to shut down the person giving them a bad review. In many cases, they just threatened to sue and that was enough to get things removed from the internet.

The site Baghdad Invest can be a witness to this if they choose to do so. It did not matter if the information was true. The idea was to use the legal system to create a financial hardship to those who revealed anything about them. Their guru/pumper network would refer to this as shutting people down. This kind of lawsuit is called SLAPP.

A strategic lawsuit against public participation (SLAPP) is a lawsuit that is intended to censor, intimidate, and silence critics by burdening them with the cost of a legal defense until they abandon their criticism or opposition. In the process, Dinar Corp would settle by gaining websites ownership or removal of content. But the owner of the site would be punished by spending anywhere from seven to twenty thousand dollars on a legal defense.

https://en.wikipedia.org/wiki/Strategic_lawsuit_against_public_participation

These kinds of lawsuits are illegal in many states, but before you would be able to recoup any money, you would spend around seven thousand or so before you could even prove that you were dealing with a SLAPP case. Even then your money would be tied up for a while before you could recoup your losses. That is, if you recouped anything at all. So before the losses got too big most people would settle without receiving anything for their legal expenses.

The problem here was Dinar Corp had deep pockets and they could tie up anything they wanted even if they had no civil legal basis to do so. So they could threaten anyone and everyone. I don’t believe anyone was off limits.

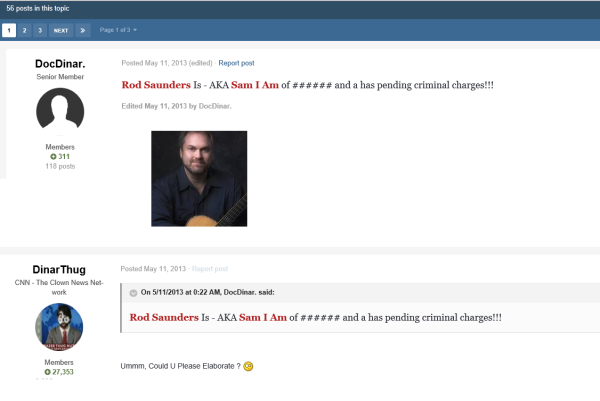

When Dinar Douchebags was in operation someone entered a comment about Dinar Corp. They contacted Sam and demanded that he close his blog down and provide the names of everybody who contributed to his site. He never replied to them and a few months later they asked him to remove the comment and he complied with their request. The only problem was Dinar Douchebags was ranking in the Google search engine along with Dinar Corp. They subpoenaed Google and Yahoo for the records to Sam’s site. Sam used Blogspot (Google) and he had a Dinar Douchebag Yahoo email address. Once they got that information they released it to their pumper network and they went right to work. Doc Dinar started a post on Dinar Vets revealing the identity of Sam I Am. This was information that they received through their subpoenas.

Both Sam and myself were threatened in that DV post. We were going to be next on the litigation list. They sent Sam a subpoena to hand over his computer records so they could look through them. It was at that time we retained an attorney and quashed the subpoena, thus ending their fishing expedition.

The irony here is they said that Rod Saunders was facing criminal charges when in fact it was Dinar Corp that would wind up facing charges a couple of years later. I was mentioned in the same post even though at the time I had nothing to do with Sam’s blog site. I was going to be shut down along with Sam I Am because we were affecting sales and we came up high in the search engine results.

http://dinarvets.com/forums/index.php?/topic/148456-douchebags-exposed-criminal-charges-pending/

They were using criminal precedence to obtain civil subpoenas. Then they were making that information public through their guru network. Only law enforcement had the right to use the subpoena in this way. At least this was what our legal counsel said. Publishing private information obtained in a subpoena for civil purposes was a big no no!

I gathered a war chest and some legal background. We had lined up a great attorney and we were ready for battle. The idea here was to move any suit to Oklahoma through a change of venue and then counter sue. Next we would reveal any records they had through discovery. Dinar Corp decided not to pursue it any further. In the end, we were glad everything remained outside the court system.

Needless to say, we were happy to see their site shut down in 2015

“The CFTC Complaint was filed under seal on July 27, 2015, and that same date U.S. District Judge Myron H. Thompson issued an emergency Order freezing and preserving assets under Defendants’ and Relief Defendants’ control and prohibiting them from destroying documents or denying CFTC staff access to their books and records. The Court scheduled a hearing for August 10, 2015, on the CFTC’s separate motion for a preliminary injunction.”

But that is not the end of the story

“Tayeh created and operates DCI and Monex NV, business entities that he uses to facilitate the Defendants’ fraudulent activities and that act as the counterparty(s) in the subject agreements, contracts or transactions in forex. Defendants operate their fraudulent scheme via the Internet through the use of their website, by offering, and entering into, transactions in forex with non-ECP retail customers that are leveraged, margined or financed by the Defendants, and that result in actual delivery of forex – if at all – within periods of not less than 15 days and as much as 120 days following the date of the transaction(s).

The Complaint further alleges that in furtherance of the fraudulent scheme, Tayeh, individually and on behalf of DCI and Monex NV, made, and continues to make, material misrepresentations and omit material facts in solicitations to actual and prospective customers via the website, including but not limited to: (1) representing that DCI operates a “fully licensed and fully compliant licensed money services business” but failing to disclose that DCI has been served with cease and desist orders in the states of Texas and Illinois for operating without required licenses; (2) representing that DCI and Monex NV provide the “best price guaranteed” and the “best prices up front all the time” but failing to disclose that the forex transactions they offer to retail customers include significant finance charges; (3) failing to disclose that DCI and Monex NV are each operating as a registered foreign exchange dealer (RFED) without being registered with the Commission as required; and (4) failing to disclose that Tayeh is acting as an associated person (AP) of an RFED(s) without being registered with the CFTC as required. Relief Defendants Hudson and Monex are alleged to have accepted funds from the Defendants to which they have no legitimate claim.”

http://www.cftc.gov/PressRoom/PressReleases/pr7206-15

Now it has just come to my attention that Husam Usama Tayeh, 36, of Oak Lawn, Illinois, the owner of Dinar Corp, pleaded guilty to committing wire fraud! In the announcement of the conviction this comment was made by law enforcement authorities

“Mr. Borg of the Alabama Securities Commission added, “the Iraqi Dinar ‘investment opportunity’ is a scam that has existed for more than a decade and has regained some of its former popularity.”

I told everyone this was a scam in 2012. We took a lot of heat for exposing this thing. The more heat we took the more I was determined to expose it.

“At some date in the coming months, Chief United States District Judge W. Keith Watkins will sentence Tayeh. At the sentencing hearing, Tayeh faces a maximum sentence of 20 years’ imprisonment as well as a fine.”

Now the government needs to round up some of these gurus. They should not get away with the profits they made from supporting this currency scam. They played a vital role in keeping this whole thing going! They are just as guilty of fraud!

Dinar Detectives (Doc Dinar & SWFG)

StarDogger

Stryker Blog (Stryker)

People Invested (Fresh & Millionday)

Currency Chatter (Randy Koonce)

Dinar Discussions

PTR/People’s Talk Radio (Dan Atkinson)

Check out the guilty plea below

http://www.wmcactionnews5.com/story/32425959/illinois-man-pleads-guilty-to-wire-fraud-in-al

Don’t forget strykers blog as well who was associated with dinar corp

LikeLike

WOW! I totally forgot Stryker. Thanks DB.

LikeLike

Oh good call DB! I forgot all about him.

LikeLike

So…. I have dinar purchased from Sterling…and if there is an RV, then my dinar are “NO” good???? It’s really hard to believe anyone… All this back and forth between these “GURUS” contradicting each other is making me believe that they are being untruthful, Sounds much like the “Political” arena between the Democratic Party and the Republican Party… CANNOT trust anyone… Sad, Sad, Sad…

LikeLike

Hi Nancy. Your dinars are probably authentic if that’s what you’re asking, but they are no good in the sense that you can’t buy anything with them or trade them for dollars at a bank. The only way to exchange them is with a dinar dealer and they are being shut down by the government. You can sell them on ebay or through Craigslist, but you’ll have a lot of competition which means you’re going to have to sell at a discount. As for the RV, it won’t happen. It was all a lie told by scammers to sell this Iraqi toilet paper. The Central Bank of Iraq has a currency reform plan to replace the IQD with a new currency, which means that the IQD will become completely (demonetized) worthless shortly thereafter. That plan is on hold because of the lack of stability and security in Iraq, so it might never happen. But whether they replace the IQD or not, it’s extremely unlikely that you will be able to get all of your money back. I sold mine at a loss, and so did Marcus. We just consider it the cost or our education in the school of hard knocks.

LikeLike

Can I check something with you Sam about the German currency – wasn’t the Reichsmark hyperinflated like the Iraqi dinar is now

LikeLike

Hi DB. The reichsmark was inflated and replaced at a ratio of 10 Reichsmark to 1 Deutschemark. Since they only lopped one zero off I wouldn’t really call it hyperinflation. Certainly nothing like Iraq’s situation where they’re proposing to remove three zeros. The real hyperinflation in Germany came after WWI when they replaced the old mark with the Reichsmark at a ratio of one trillion to one. You can see the tables on this at http://www.history.ucsb.edu/faculty/marcuse/projects/currency.htm

LikeLike

Great Article Marcus and great response to Wanda Marcus and Sam

LikeLike

I was wondering why you call it a scam? I thought a scam is when you do not receive something you buy. I see how they did something illegal but a scam does not make sense to me. I never bought any from them anyway. It seems that the reason they got arrested is because they didn’t have enough dinar to put on layaway when people paid down. I’m sure that is a reason why they got arrested in the first place. I cannot call it a scam myself just illegal.

LikeLike

It is a scam because many dealers know that the dinar will not revalue. In fact, you can even find that fact in Sterling’s indictment. They knew it would not revalue but they are marketing it as though it will. They have hired gurus which are people who are being paid to present the dinar as a real investment. Whenever investments are made an investment advisor needs to disclose the risks involved. The dinar is marketed as a sure thing. In addition, none of these guys have the license in place to market the dinar as an investment. In this case, they did not even have the proper license to sell the dinar as a reserve. This is according to the press release regarding the guilty plea. (see the links} These guys know the dinar will never revalue and they hire third-party gurus to lie and say it will revalue. They make up junk economics and say things that make no sense in an effort to deceive people who know nothing about currency exchange and economics. They wind up robbing the poor and the people who put hope into their deception. That is why it is a scam. These guys are selling something based on the many lies that say this is an actual investment when all the while they know it is not an actual investment. The dinar will never pan out. The dinar will never revalue…..and they knew that the whole time!

LikeLike

Wanda, a scam is defined by Merriam-Webster as a fraudulent or deceptive act or operation. Dictionary.com defines it as a confidence game or other fraudulent scheme, especially for making a quick profit; swindle. The bottom line is deception. What makes the dinar investment a scam is the lies that are told to sell it. If the dinar dealers were to tell people the truth about the dinar nobody would want it. The truth is the Central Bank of Iraq has a policy of exchange rate stability. You can’t make a profit if they keep a stable exchange rate. The truth is the CBI’s currency reform plan is a redenomination (lop), not a revaluation. Nobody profits from a redenomination. The truth is Iraq backs their currency with their foreign currency reserves like all of the other oil producing countries of that region. They will never back it with their oil. Their reserves are about $50 billion and their money supply is about 60 trillion. The rest is just simple math. The truth is Germany didn’t revalue their currency after WWII and Kuwait didn’t revalue their currency after Desert Storm. They both redenominated. Nobody got rich from either situation. There are a hundred more lies I could mention, but the bottom line is the dinar investment is a scam because dinar dealers are marketing it through lying pumpers to make lots of money through fraudulent means. It’s like selling a house without telling the buyers that it is sitting on a former landfill, or selling regular beans as magic beans. The dinar will never go up in value more than a few % here and there, and that makes it nearly impossible to make any profit at all once you figure in the markup, and completely impossible to get rich from it.

LikeLike

I’m still hoping that what you guys think will redonominate will in actual fact result in a re- evaluation of the dinar value. I’m going in kamakazi style till the end no matter what

LikeLike